Benefits

Earn dividends

Enjoy competitive interest rates on your savings.

No fees

Absolutely no monthly fees. None!

Free Online Banking

Use our online banking to manage your accounts from your computer or mobile device.

Easy access

In addition to online banking, access your account in person, via ATM, or through Telephone Banking.

Free ATM card

Enjoy access to nearly 30,000 surcharge-free ATMs around the world.

eStatements

Enjoy the ease and convenience of paperless eStatements.

Share Savings

By opening a Share Savings Account, you become a Statewide member and get access to all of our membership benefits.

- $5 minimum opening deposit

- $5 minimum balance (required to earn dividends)

- No variable rate.

- Free eStatements

- Electronic withdrawals are limited to six per month, but all other withdrawals and transfers are unlimited.

- Dividends are compounded daily and credited monthly.

- Remain a member as long as you have an active Share Savings Account.

Club Savings

Looking to save up for something special, like a vacation or the holiday season? Our Club Savings account makes it easy for you to hit your goal. Put money aside with payroll deductions or direct deposit to streamline your savings.

- $0 minimum opening deposit

- $0 minimum balance

- No variable rate

- Withdraw money anytime of the year. Electronic withdrawals are limited to six per month, but all other withdrawals and transfers are unlimited.

- Dividends are compounded daily and credited monthly.

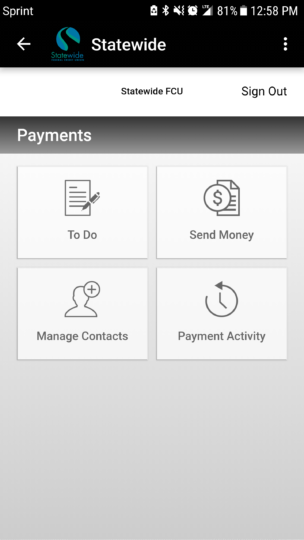

WITH ONLINE AND MOBILE BANKING, ACCESS YOUR ACCOUNTS 24/7.

We love to see you at our branches! But we know life can get busy, and you need to access your account on the go, anytime, anywhere. Save time with our online and mobile banking and mobile deposit.

Learn More

Think of our tips, tutorials and calculators as your very own financial playbook.

Ready to open a Statewide Savings Account?

STOP BY ONE OF OUR BRANCHES

CALL US

Disclosures

*We issue a free Visa ATM/Debit Card to those who qualify.

** View our Overdraft Privilege Policy